|

A Better Holyoke for All Political Action Committee

Keep Holyoke Affordable For ALL

https://www.betterforholyoke.com/

Public Education Meeting Oct. 22

Watch video replay of the event

See details here

The mission of A Better Holyoke for All Political Action Committee

is to highlight a variety of issues that affect Holyoke's well being, to educate the citizens

and to alert tax payers and families to

critical decisions that would affect us all.

Our goals: We are an issue-based, rather than ideologically-based, organization, focused locally rather than nationally, with the goal of building our city's economy for the benefit of all our residents, rather than a select few. We take positions on issues in line with our goal, and on which there is broad consensus across our communities, despite all the "noise" coming from special interests. We back candidates who stand with us on those issues.

We support candidates who strive for restraint of government spending.

We have a tax & spend administration and we need independent city councilors to provide a balance in city government.

There is no choice for Mayor in the 2025 election but you can choose city councilors who will look out for you & your wallet.

Issue One: Supporting the Holyoke Gas & Electric as one of our city's greatest assets.

The HG&E is a great incentive for bringing businesses into the city. We don't want to completely contradict that by preventing it from doing its job, for what are essentially political,

rather than practical, reasons. While we support the preservation of our natural environment, that is not best accomplished through actions that are at best largely symbolic,

and in fact become completely counterproductive by forcing many of our residents to continue burning dirtier and more costly fuels.

Therefore, we call for an end to the natural gas moratorium currently in effect in Holyoke. The Holyoke Gas and Electric can be a driving force for the city's future development.

Our city's economic development is being held back because we are refusing to allow new businesses and residences to access natural gas.

Thousands of Holyoke residents rely on natural gas service and they should not be forced to pay tens of thousands of dollars in conversion costs. We support Holyoke Gas & Electric's Expansion of LNG Storage

as a long term solution to enhance our natural gas capacity to Holyoke that can end the natural gas moratorium quickly. The city should avoid the hundreds of millions in costs and rate increases our city and residents cannot afford by preserving our natural gas service.

|

(Click to Enlarge, Save/Print, Back button to Return)

en español

|

Issue Two: Keeping Holyoke an affordable place to live.

City finances in recent years have been poorly managed. Taxes are at an all-time high. Holyoke now has the highest residential tax burden in the state. We have a shrinking commercial base. Even though more and more taxes are paid each year, there is never enough. Free cash is gone. Holyoke leaders need to act more responsibly to ensure department budgets are not overspent, and that cash reserves are properly maintained, and that the city has an effective capital plan. It is striking how unequitable the current system of local funding based on property values is for Holyoke as compared to our wealthier neighbors; we need leadership that will advocate for a fairer system, and our fair share of state aid. The state's reliance on current property tax system and antiquated funding formulas is no longer acceptable and has significantly contributed to the city's structural deficit. Moreover, these revenue streams do not account for the systemic poverty and social needs of a community like Holyoke. There is nothing progressive about regressive taxation. The formula by which Holyoke is funded by the state is very regressive and needs to be updated now.

Holyoke Citizen Speaks Up on CPA [PDF]

Coming soon: BFHA Positions on key issues, upcoming January Vote to make the Holyoke Treasurer job Appointed rather than Elected, dealing with Property Taxes

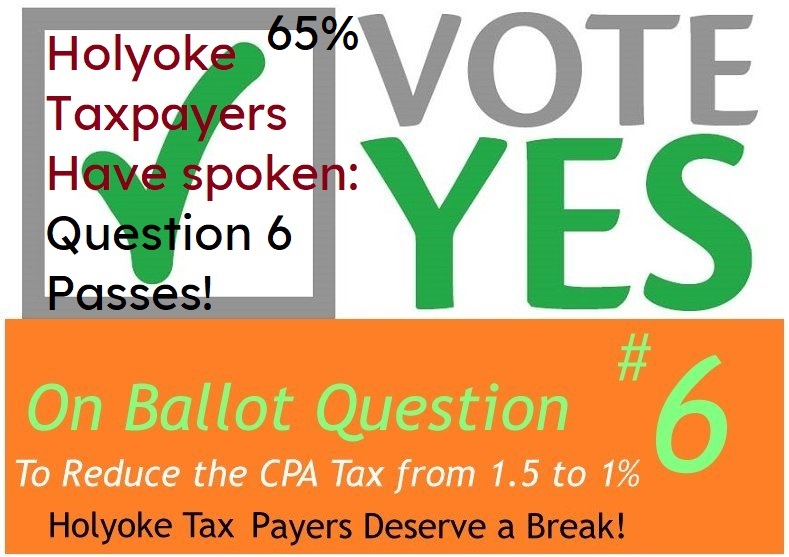

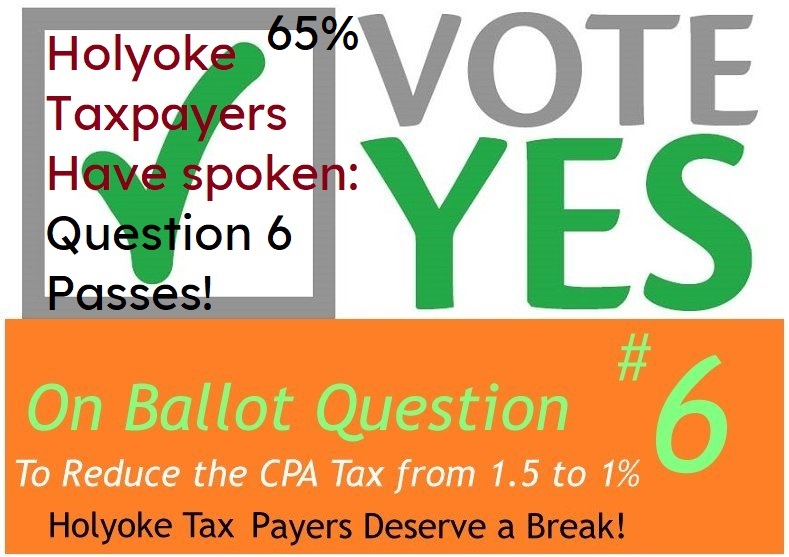

Holyoke Votes "Yes" on Ballot Question 6!

Almost 2 to 1 Vote by the citizens standing up to excessive taxation

The mission of A Better Holyoke for All can be stated in a single sentence: Keep Holyoke affordable for all. In that spirit, we strongly urge a “Yes” vote on ballot question 6 this November 5th, which will reduce the Community Preservation Act tax surcharge (or simply “surtax”) from 1.5% to 1.0% of the assessed value of real estate.

Yes, in itself it is but a small step – although for the many in Holyoke with limited/fixed incomes every dollar counts – but the cumulative effect of this surtax, along with all the regular property tax increases in recent years, is quite substantial. Also, we hope, it will help convey the message to those in the city administration, most of whom are much more comfortable financially than the average resident, that they must maintain a balance between ambitious projects, which may well improve the quality of life here, and the ability of very people intended to benefit from them to continue living here.

Click here to continue reading

As not everyone may realize, the principal source of municipal financing, the tax on real estate, which is paid not only directly by the property owners, but indirectly by tenants through their rent as well, is perhaps the most regressive form of taxation in existence, meaning that those with more expensive homes, who tend to be wealthier, literally pay more dollars, but as a percentage of their income they actually pay the least, while those with lower incomes actually pay the most, taken as percentage of their income.

Rising property taxes, notwithstanding the purported benefits they're paying for, clearly have negative consequences; not only are they a driving force behind rent increases, but can force retirees on fixed incomes out of the homes they worked so hard for many years to pay for (if it hasn't happened here yet, it certainly has elsewhere). In short, while it is typically considered a conservative position, when it comes to property taxes, no one who is concerned about housing insecurity should be a fan of them.

The Community Preservation Act surtax does not fund the city's general operating budget, although in a few cases it has been used for renovations of city properties. Instead, grants from the CPA fund ordinarily go to nonprofit organizations, but in one recent and notable exception to a private developer.

In its first years, the early-to-mid 2000's, the CPA was rightfully touted as a windfall to participating communities, with 100% matching annual distributions from the state CPA trust fund; much less frequently mentioned is that the distribution percentage has generally been on a steep decline since then, most recently down to 21% Since its adoption of the CPA in 2018 Holyoke has cumulatively received a 29% match.

While there are several exemptions available from the surtax, except for the one for the first $100,000 of valuation, seniors and low-income people must work very hard to obtain them, including compiling tax returns, income verifications, and documentation of all out-of-pocket medical expenses. And the process must be repeated every year.

It has been argued that relatively tiny CPA grants are somehow “leveraging” multi-million dollar housing projects. For example, in the last application cycle Way Finders requested $250,000 (having previously received another $250,000 a few years previously) for the $28.5 million Library Commons, Phase 2 project, and WinnDevelopment, the aforementioned for-profit developer, requested $300,000 for the $55.3 million Appleton Mill, Phase 1 project. No doubt the developers were more than happy to received any grant money they could from the residents of Holyoke, but, notwithstanding their dire assertions to the contrary, it stretches all credulity that they would walk away from investments of that size for lack of grants amounting to, respectively, 0.88% and 0.5% of their total budgets, rather than finding alternate funding. And what completely belies this claim is that the developers ended up accepting grants of, respectively, $100,000 and $200,000 without throwing in the towel.

In 2019 the voters of Holyoke made history by defeating, against all odds, a reckless debt exclusion, not because they were opposed to building schools or the future of our children, but because they recognized the futility of doing so at a cost that would be financially disastrous, and likely drive the cost of housing so high it would force the families of many of those same children to leave. Just as we said, there was a better way, and as we saw the city came back with a new proposal that was still of the highest quality, but far more economical and well within our means.

On November 5th we can make history again, this time with a “Yes” vote. Once again, it is not about being against any and all projects, but the larger understanding that they profit us nothing if we can no longer even afford to live here.

Finished reading

A Better Holyoke for All Political Action Committee, David Yos Treasurer

Back to Top

|

|